Globax news

Blog

Conveyor System Market by Industry – Global Forecast to 2025

Some reports indicate that the conveyor system market will see growth in the next few years.

According to Markets and Markets:

The global conveyor system market size is projected to reach USD 10.6 billion by 2025, from an estimated value of USD 8.8 billion in 2020, at a CAGR of 3.9%. Higher adoption of automation processes in various end-use industries and rising demand for handling larger volumes of goods are the driving factors that are expected to boost the conveyor system market.

Covid-19 Impact On Market

The COVID-19 pandemic has disrupted markets on a global scale. The material handling industry is experiencing an uncertain recovery timeline due to lockdown implementations in various parts of the world. Lockdowns and partial operations of manufacturing facilities and distribution centers have delayed new orders for conveyor systems. However, the rising trend in e-commerce is expected to boost the demand for conveyor systems. Conveyor system manufacturers have seen significant changes in business operations because of the COVID-19 crisis. In response to the Japanese government’s Basic Policies for Novel Coronavirus Disease Control announced on February 25, 2020, Daifuku Co., Ltd. established a Novel Coronavirus Response Committee with the company President as its head. Europe has already witnessed a second wave of COVID-19; a second wave in other countries could further impact the growth of the conveyor system market until a vaccine is developed.

The conveyor system market is witnessing significant slowing down of operations due to the COVID-19 pandemic. According to the United Nations Industrial Development Organization (UNIDO), global manufacturing output registered a decline of 6.0% during the first quarter of 2020 due to lockdown measures due to the COVID-19 pandemic. Demand for conveyor systems for new manufacturing facilities and distribution centers have been delayed due to supply chain disruptions. As per MnM projections, the industry is expected to recover at a significant rate during the forecast period due to the increase in the demand for automated conveyor systems during the post-COVID-19 scenario as compared to the pre-COVID-19 scenario.

Market Dynamics

Driver:Rising demand for handling larger volumes of goods

Various upcoming investments are expected in the mining industry in Latin American countries, particularly in Brazil and Chile. As mining requires handling larger volumes of goods, the conveyor system is the preferred as well as economical solution for long distances. The increasing purchasing power of consumers and economic growth in these regions are the key factors that have encouraged the growth of the manufacturing industry. Automation in manufacturing, baggage handling, food & beverage, mining, and various other industries has brought the industry closer to the zero-defect target.

Restraint:Increasing usage of automated guided vehicles and robotics

An increasingly highly competitive environment across all industries is leading to companies constantly looking for process optimization, which in turn has increased the demand for the automation of industrial facilities. The industry has witnessed various ongoing advancements in automation. These can help in meeting requirements related to material handling capacities, resulting in reduced production time, fewer chances of human error, increased safety, high production volume, and increased accuracy and repeatability. Due to such benefits, an increasing number of companies are adopting such technologies for material handling processes. According to the International Federation of Robotics (IFR), in 2020, ~2.7 million robots worked in factories around the globe. Large-scale adoption of industrial robots may impact the conveyor system market negatively. However, the impact is expected to be limited because of the high cost of automated guided vehicles.

Opportunity:Increase in demand for material handling from warehouse and pharmaceutical companies during the COVID-19 crisis

The production and distribution of personal protective equipment (PPE) kits and medicines such as hydroxychloroquine (HCQ) tablets increased during the ongoing COVID-19 crisis. The supply of essentials and the manufacture of medical equipment is expected to drive the pharmaceutical and healthcare industries, and this is expected to further boost the demand for material handling. India is the world’s largest producer of HCQ tablets. In this rare scenario, the production of HCQ tablets is boosting the healthcare industry, especially in India. Recently, the Indian government started exporting HCQ tablets to 55 countries. Initially, exports were banned but granted later in view of the humanitarian aspects of COVID-19. Approximately 13 countries have already received the drug which is being supplied through commercial channels and as grants-in-aid as well. Such increased demand from the pharmaceutical and warehouse & distribution industries during the COVID-19 crisis is expected to drive the demand for conveyor systems.

Challenge:Ensuring safety and reducing accidents

Conveyor systems have several moving parts and are, hence, prone to several minor problems that might amplify into major issues leading to complete halting of work. For instance, in the case of seized rollers, the final products may develop some minor defects leading to significant losses to the company. The more complex these systems are, the higher the chances of failure. Also, continuous breakdowns may negatively impact the life of the conveyor system. Such issues lead to a high maintenance cost, which constitutes a substantial part of the cost of ownership of a conveyor system. Several accidents have caused severe losses to companies. For example, in December 2020, a female worker was injured when her arm was caught in a conveyor belt at a plant of Tyson Foods (US). Occupational Safety and Health Administration (OSHA) is the federal agency that establishes norms and provides guidelines for every industry, including automation. It also provides warehouse safety solutions for common hazards that may occur while working with conveyor systems. Companies need to abide by the norms set by OSHA to reduce accidents and increase the safety of employees. Elimination of accidents therefore is a challenge for the conveyor system market.

By component, aluminium profile is projected to be the largest market during the forecast period

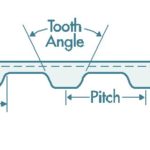

The market for the aluminum profile conveyor support is projected grow during the forecast period. Fluctuations in prices of aluminum are expected to directly impact the growth of the market. The profile works as a firm support for the belt to ensure that it does not sag when the weight of an item is placed on the belt. Aluminum profile conveyor supports are crucial for the efficient operation of a conveyor system as these ensure proper loading and unloading of material. Europe is estimated to account for the largest share in the aluminum profile segment in 2020 as the region is home to some of the aluminum profile conveyor support manufacturers such as FlexLink (Sweden).

Automotive industry to attract conveyor system manufacturers owing to the growth of the automotive industry in Asia Pacific region

Increasing vehicle production in the automotive industry during the recent past has resulted in the increased demand for conveyor systems. Conveyor systems help automotive plants work at a higher efficiency to meet the desired production levels. The Asia Pacific is expected to fuel the growth of automotive conveyor systems owing to the growth of the automotive industry, especially electric vehicle production in China and India. China is the largest vehicle-producing country in the region. It is home to various global as well as regional automotive manufacturers such as BYD Automotive, Geely, Dongfeng, Volkswagen Group, and Ford Motor Co. Other than OEMs, there are various Tier 1 players such as Mitsubishi Electric, Denso, and foreign players such as BorgWarner, Robert Bosch GmbH, and Continental AG. The presence of large players drives the growth of the conveyor system market in the region. In terms of conveyor technology, roller and overhead conveyors are expected to lead the market during the forecast period.

Conveyor system market for retail & distribution to be dominated by North America

Increase in purchasing power, lifestyle changes, increasing working class, and relaxations in government regulations such as FDIs have fueled the growth of supermarket/hypermarket chains along with distribution centers. North America is projected to account for the largest market share in the pallet conveyor system market for the retail & distribution industry during the forecast period. Pallet conveyors are ideal in case of space constraints. Small or medium-sized distribution centers in North America use pallet conveyors to handle extremely heavy loads and are majorly utilized to handle inventories.

Europe is projected to grow at the highest CAGR during the forecast period

Europe, being an early adopter, witnesses’ extensive applications of conveyor systems in several industries. Conveyor system manufacturers in the region have invested in research & development for innovating improved technologies to stay competitive in the market. Germany and the UK are at the forefront of industrial research and engineering. Extensive R&D infrastructure, a highly qualified workforce, and complete industry value chain integration create an environment that enables companies develop cutting-edge technologies. Production levels in the food, retail & distribution, automotive, and aviation industries have witnessed significant growth in Europe and are projected to increase further in the future.

Key Market Players

Daifuku Co., Ltd. (Japan), Continental AG (Germany), Siemens AG (Germany), and Fives Group (France) are some of the leading manufacturers of conveyor system in the global market. These companies developed new products; adopted expansion strategies; undertook agreements, partnerships, and supply orders; and used acquisitions to gain traction in the conveyor system market.

The study categorizes the conveyor system market based on type; operation; component; for the airport industry, by conveyor type; for the automotive industry, by conveyor type; for the retail & distribution industry, by conveyor type; for the electronics industry, by conveyor type; for the mining industry, by conveyor type; for the food & beverage industry, by sub-industry; and region.

By Type

Belt

Roller

Pallet

Overhead

Tri planar

Bucket

Floor

Cable

Crescent

Others (combination of any of the aforementioned conveyor types or gravity, chain, and vertical conveyors)

By Operation

Manual

Automatic

Semi-automatic

By Application

Mineral

Metal

Coal

By Component

Aluminum profile (conveyor belt support)

Driving unit (motor bracket, counter-bearing, and electrical drive)

Extremity unit (pulley and clamping strap)

Airport industry, by conveyor type

Belt

Tri planar

Cresccent

Others (gravity, chain, overhead, and vertical conveyors)

Automotive industry, by conveyor type

Overhead

Floor

Roller

Others (gravity, chain, overhead, and vertical conveyors)

Retail & distribution industry, by conveyor type

Belt

Roller

Pallet

Others (gravity, chain, overhead, and vertical conveyors)

Electronics industry, by conveyor type

Belt

Roller

Others (gravity, chain, overhead, and vertical conveyors)

Mining industry, by conveyor type

Belt

Cable

Bucket

Others (gravity, chain, overhead, and vertical conveyors)

Food & beverage industry, by sub-industry

Meat & poultry

Dairy

Others (baked goods, confectionery, seasonings, and sauces)

By Region

Asia Pacific

Europe

North America

Rest of the World

Recent Developments

In May 2020, Continental AG introduced the Sybercord Steel Cord technology. It provides conveyor belts with Sybercord steel cords as a tension member which offer a higher dynamical breaking load with a simultaneous reduction of the cord diameter when compared to a standard steel cord belt. The design of the cord provides optimal corrosion resistance. Sybercord steel cords are also more flexible than any other steel cord used for the manufacture of conveyor belts.

In September 2020, Siemens Logistics introduced the world’s first Misplaced Item Clearer (MIC) for cross-belt sorters in parcel sorting centers. The device uses sensors to detect small size and low weight items that are accidentally positioned between cross-belts. MIC automatically removes them using compressed air and moves them into an outlet. Thus, consignments can be processed immediately without interrupting sorter operations. MIC express helps distribution centers at airports adhere to small time windows during which parcels need to be processed and distributed to connecting flights.

In August 2019, it acquired Netherlands-based Scarabee Aviation Group B.V. and Australia-based Intersystems (Asia Pacific) Pty Limited. Scarabee provides a range of airport solutions to many of the world’s leading airports and airlines while Intersystems provides airport information management systems, including its world-leading flight information display (FIDs) software. With these acquisitions, Daifuku Group is expected to enter the airport security checkpoint and information management fields.

In October 2020, Austrian Post, a logistics and postal services provider in Austria, selected Fives to automate a new distribution center in Vomp. The new solution comprises Fives’ proprietary technologies such as the GENI-Belt cross-belt sorter, GENI-Feed induction lines, and a singulator. As the integrator of the project, the company is expected to provide the upstream, different types of chutes, a handling system for non-compatible items. and the software control for the entire system. The new automated handling system is capable of sorting 10,000 items per hour.

In December 2019, XPO Logistics, Nestle, and Swisslog created a Digital Distribution CentEr of the Future – a new USD 77 million facility at the SEGRO East Midlands Gateway, UK. Swisslog provided advanced sorting systems and robotics. At the distribution center, the process begins with the goods arriving in the building on pallets. These are then lifted by machine onto a conveyor and taken to a monorail.